Essential Insurance Coverages for Home Stagers

Understanding the specific risks in the home staging industry is crucial for proper protection. PenEx offers a suite of essential insurance coverages designed to address the unique challenges home stagers face. We craft policies that safeguard your business from common claims, unforeseen accidents, and professional liabilities.

Get home staging business insurance in less than 48 hours. Fill out our easy online application.

General Liability Insurance for Home Stagers

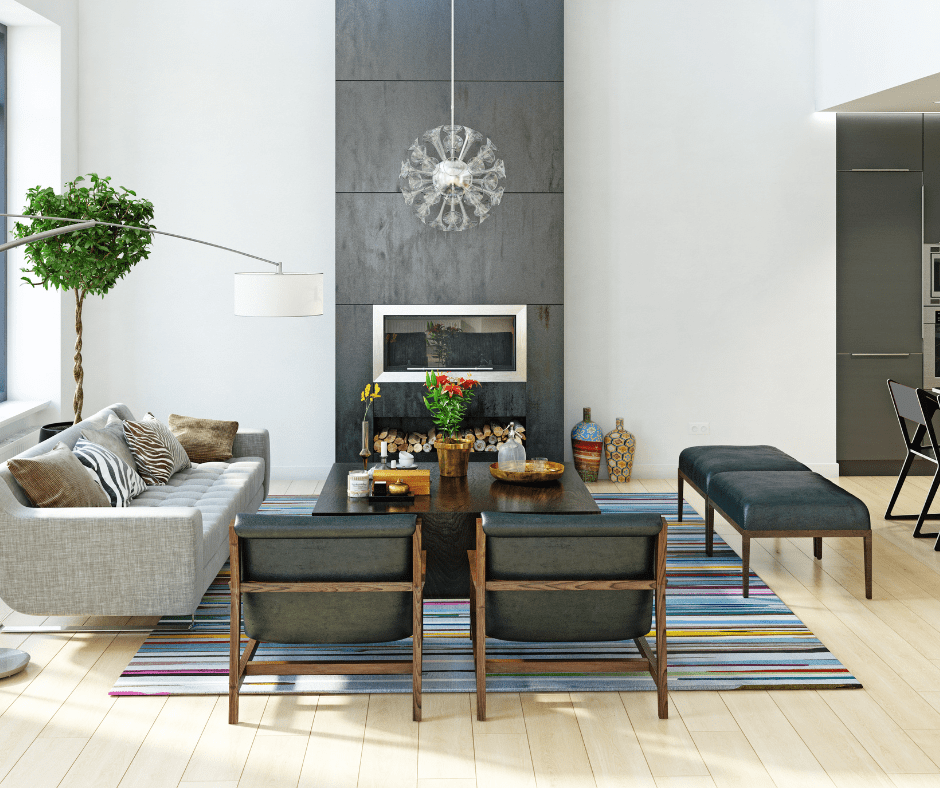

General Liability Insurance for home stagers is your foundational protection against third-party claims of bodily injury or property damage. Imagine an accidental scratch on a client’s newly refinished floor while moving furniture, or a potential buyer tripping over a staged rug during an open house. This coverage helps protect your business from the financial burden of such incidents, including legal defense costs and settlement payments, ensuring your operations aren’t derailed by unforeseen accidents.

Staging Inventory & Commercial Property Insurance

Your staging inventory is a significant investment. Our Staging Inventory Insurance, often part of a broader Commercial Property policy, protects your valuable furniture, artwork, and décor against perils like theft, fire, vandalism, or accidental damage. This coverage extends whether your items are in storage, in transit, or actively staged in a property, providing critical financial security for your most important assets. We understand the high value of your design elements and ensure they are adequately protected.

Professional Liability (E&O) for Home Stagers

Also known as Errors & Omissions (E&O) insurance, Professional Liability Home Staging coverage protects you from claims alleging professional negligence, errors, or omissions in your staging services. If a client claims your design advice or staging work led to a financial loss for them, this policy can cover legal fees and damages, even if the claims are unfounded. It’s vital protection for your reputation and expertise.

Workers’ Compensation Insurance

If your home staging business has employees, Workers’ Compensation Insurance is typically required by law. This coverage provides medical benefits and lost wages for employees who are injured or become ill as a result of their work duties, such as moving heavy furniture or installing decor. It protects both your employees and your business from potential lawsuits arising from workplace injuries.

PenEx Policy Limits For Home Staging Liability Insurance

- $1,000,000/$2,000,000 in business general liability coverage (on and off-premise)

- $25,000 for customers’ property in your care, custody, & control, or higher limits

- Staging inventory protection at home/office, and while temporarily off-premises, whether in a house for sale or while in transport. Rental furniture and equipment are also included in this coverage.

- Hired physical damage to rent trucks up to $75,000

- Office equipment and storage location coverage

- Low policy deductible

Home Staging Insurance for RESA Members

RESASURE is a specialized program designed exclusively for current RESA Members. It offers tailored coverage, providing discounts and enhancements to your insurance and risk management subscription. From liability and property damage to professional errors and omissions, this program ensures comprehensive protection for your business.

Start SRM Staging Policy for Full Protection

SRM Staging Policy offers tailored risk management solutions for real estate stagers. This service assesses potential risks at each staging location and provides recommendations to mitigate them. With flexible payment options and personalized insurance coverage, this program helps protect your business from unforeseen incidents while staging homes.

What Is The Importance Of Insurance For Home Stagers?

Home staging involves moving furniture, decorating, and working on properties that don’t belong to you. Even with the utmost care, accidents can happen:

- Accidental Damage: A valuable item in the client’s home gets damaged during staging.

- Injuries: A visitor trips over your equipment or staged items, leading to a liability claim.

- Professional Errors: A client claims financial loss due to perceived negligence in your staging services.

Home Staging Liability Insurance offers the peace of mind you need to focus on creating stunning spaces without worrying about unforeseen risks.

How Does Home Staging Insurance Help Your Business?

As home stagers, insurance with PenEx gives you peace of mind, as well as financial security and assistance in the event of an unforeseen occurrence or claim.

With home staging business insurance, you can concentrate on your business without fear of a potential risk. It is essential to work with a skilled insurance agent to tailor insurance coverage to your unique company’s needs and risks.

For more information about PenEx and how their experts can assist your business, be sure to get a free home staging insurance quote from us.

Hear About Home Staging Insurance From Other Home Stagers!

“I was thankful to find an insurance company that specialized in policies for Home Staging and Design.”

– Skinny House LLC“As a Residential Staging Expert, a member of Real Estate Staging Association (RESA), and a member of Certified Staging Professional (CSP) certification, I am so glad that I am protected and in good hands. The PenEx team is very professional, always there to answer questions and take care of any payment inquiries about my policy. I have sent referrals of my CSP stagers and non-CSP stagers to Pen-Ex, and they have obtained the insurance coverage. I highly recommend if you do not have insurance coverage for your staging inventory to consider joining the Pen-Ex staging insurance team!”

– Yolanda Tillman

Get Your Custom Home Staging Insurance Quote Today!

Don’t leave your home staging business vulnerable to unforeseen risks. Partner with PenEx for reliable, specialized Home Stager Insurance that gives you confidence. Our friendly experts are ready to discuss your specific needs and build a policy that provides maximum protection.

Home Staging Business Insurance FAQs

Specific home staging insurance is not required, however, in most states, general liability insurance is required for all businesses. Choosing a general liability policy from a company that specializes in home staging insurance, like PenEx, will not only save you money, but will also protect you from common claims in your industry. Moreover, using PenEx’s signature Professional Liability Endorsement, can help close that gap with potential claims. PenEx specializes in home staging claims and risk management. We have seen it all and can help protect your home staging business with lawyer-reviewed pre-staging agreements and other risk management services.

Yes, having business insurance is strongly suggested when establishing a home staging business. Having home stagers insurance can help protect your business from any unplanned risks and errors.

Yes, depending on your business requirements, you can typically customize your policy to include extra coverage choices such as cyber liability insurance, business interruption coverage, or commercial auto insurance.

Yes, insurance for home stagers frequently includes professional liability coverage, which can protect against client claims alleging financial damages as a result of errors or carelessness in staging services.

If you have a covered incident or claim, contact your home staging insurance provider as soon as possible to initiate the claims process. They will guide you through the necessary steps and documentation required when starting the claims process.