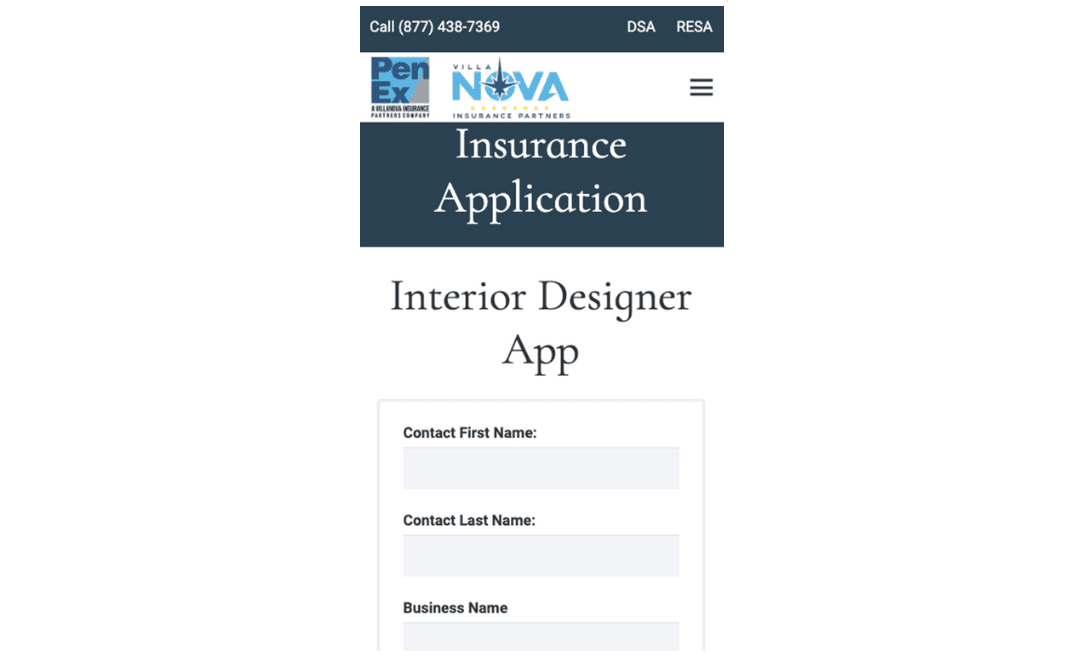

1. Contact and Business Information

The information that you provide for your Interior Design Insurance Application is critical data that the insurance company uses to make determinations such as if the insurer will provide coverage, how much coverage they will provide, what type of coverage they will provide, and the level of risk in providing coverage to you. Your contact and business information is the first place to review for any inaccuracies. Where this particular portion of the application becomes extremely important is in the case of businesses who use an alias or DBAs to “do business as.” When operating under a DBA, it is essential that you are insured properly.

2. Operations & Revenue

During the interior design insurance application process, a section of the application will require information regarding your operations and revenue. This information is quite relevant in securing a policy that includes business income insurance or business interruption insurance. This type of coverage can be essential in the event your business is shut down; for example, your facility is damaged by flood or fire. Business income insurance can help pay for the lost revenue during such shut downs. As part of your Business Owners Policy this coverage can assist in covering payments, revenue, or property damages in such an event. Estimates of revenue are acceptable in situations where actual numbers are unavailable. This is often the case with most start-up companies.

3. Business Location Information

Providing your business location or physical address is an essential component of your application. A key component of your Business Owner’s Policy is premise liability. This particular coverage protects you in the event someone is injured on your property. Regardless of whether you rent or own the property, premise liability protects you and your enterprise from a potentially devastating claim. Including all of your business location information is critical to ensuring you are adequately covered if such an unfortunate event should occur.

4. Auto Use for Business

Applications that require information regarding your automobile used for your interior design business utilize this information to create your commercial auto insurance coverage. This insurance protects you and your business in the event of an accident involving a business-owned automobile. Commercial auto insurance policies will cover costs involving business-owned automobiles such as damage to other vehicles, physical damage, medical expenses accrued from accident, and legal fees if litigation is brought against you.

5. Subcontractors

In the Interior Design industry, businesses often enlist subcontractors to perform various tasks of a particular project. It is important to have accurate information regarding your subcontractors in your insurance application to ensure you are properly covered in the case of a claim filed against you or one of the hired subcontractors. Interior design insurance applications will request if your subcontractors have their own Errors and Omissions Insurance, General Liability Insurance, and Workers Compensation Insurance. The application will also inquire as to whether or not your business is listed as an additional insurer on those policies. Documentation will be required to prove that you are listed as additional insurers in your subcontractors policies.

For more information about how to hire subcontractors for your design business, check out our blog topic to further answer any questions!

6. Risk Management

Risk management is an integral part of the interior design industry. As part of the interior design insurance application process, risk management is an important component by providing means of mitigating risks in your business. Using subcontractor agreements and service agreements are essential components of risk management for interior designers. Being properly insured with General Liability, Errors and Omissions, and Workers Compensation coverages and requiring that your subcontractors are properly insured is an excellent means to reduce potential risk. At PenEx, powered by Villanova Insurance Partners, it’s our mission to help you grow your business. We offer such agreements to our clients upon request.

7. Employees

Applications for Interior Design Insurance will require your employee information. This data is necessary in creating an appropriate workers compensation policy for your business. Workers compensation covers your employees or possibly your contractors in the event they are injured at work.

Starting our interior design insurance application is a simple but critical step in protecting you as a designer. Providing accurate and detailed information ensures that the right coverage is customized for your specific design business, granting you peace of mind and allowing you to focus on what you do best, designing exceptional spaces for your clientele!

Don’t delay! Fill out our online application today and allow PenEx, powered by VillaNova Insurance Partners, to provide your business with a secure and comprehensive insurance policy for your interior design ventures.